Jew·el·ry /ˈjo͞o(ə)lrē/

noun

- personal ornaments, such as necklaces, rings, or bracelets, that are typically made from or contain jewels and precious metal.

This may seem like a terribly stupid question, especially in a jewelry blog, but it turns out to be important. The issue has to do with insurance.

Jewelry vs. Diamonds and Other Loose Gemstones

Much modern jewelry, especially engagement rings, are usually made up of a single primary diamond with a ring made of gold or platinum, possibly a few more diamonds, and a bunch of labor. Traditionally this came from a jewelry store or perhaps an inheritance, but increasingly in the internet age there’s a new method: Buy a diamond from some out-of-state dealer. Get it appraised by a different out-of-state-appraiser to confirm it is what you expected. Have it set in a ring made by a 3rd supplier, possibly in a 3rd state, possibly using a mounting that was manufactured by a 4th supplier. It’s logistically a bit complicated but it raises a curious set of insurance problems. When does it become insurable?

Insurance Riders

Most of the major insurance companies, the ones whose names you know, insure jewelry using what they call a ‘rider’. This is a supplement to a homeowners or renters policy. They don’t stand alone, and it’s one of their most popular offerings. A significant fraction of their clients have at least one. The thing about jewelry riders is that they are generally written to insure “jewelry,” not loose diamonds. Diamonds are components. This means that, in the above scenario, the consumer isn’t insured until the very end. The various jewelers, appraisers, and shippers may or may not have their own policies, but the homeowner’s company won’t take it until it is“jewelry,” as they define it. Loose diamonds don’t count. Even the mounting (before the stone is set in it) doesn’t count.

Perils

This all opens up several perils for the consumer who thought they were insured:

1. Damage to the stone before it arrives.

If the unmounted stone arrived scratched, chipped, or otherwise damaged in a way that isn’t noted on the lab report, that’s “pre-existing damage.” Not only is it not covered, it may prevent them from underwriting the policy at all. This may be covered by the seller—or not—depending on their terms and conditions and the fine print on the receipt. This could fall under a ‘material misrepresentation’ clause in the sale and be covered by the credit card; or, it may fall under an insurance policy of the seller, if you can prove it and if they are cooperative… or you may just be out of luck. The prudent procedure is to get the loose diamond or gemstone appraised IMMEDIATELY when you get it and before you take it to be set. Use an outside, independent, appraiser who doesn’t work for either the seller or the setter.

2. Damage caused by the setter.

Most setters carry insurance against fire, theft, etc. and a separate sort of policy for things that they are selling, but most do NOT have insurance against their own craftsmanship with items they didn’t sell. This is routinely mentioned in the above mentioned ‘fine print’ and you should absolutely read it. If they didn’t sell it and they damage it—even through negligence—it may be on you.

Prudence here depends on your insurance company and your setter. Most setters with sense want an independent appraisal done immediately before you drop your diamonds or gemstones off. They won’t even accept the job without it. This is a CYA policy for the jeweler and, as annoying as it seems, it’s a good sign of quality if they require it. The last thing they want is an argument with you at pick-up time about a nick that was there before they even saw the stone.

Every appraiser I know offers this service. Ask the jeweler flat out about insurance or at least their willingness to accept responsibility if something goes wrong. Consider finding a different jeweler if the answer is ‘no,’ but this may be more difficult than you think. As a general rule, you can avoid a lot of finger-pointing if you can arrange to buy the diamond, the mounting, and the labor all from the same source. If you can’t, or won’t, do this, I’ll explain a procedure at the end.

3. Craftsmanship and condition problems with the mounting.

These are the things other than the center stone. It’s common that the ring is manufactured by someone other than the setter. There are large national companies that specialize in ring making. You may or may not recognize the brands, and some are a lot better than others about standing behind their work. But the risks here go beyond even the mounting. If, for example, a prong breaks off a year later and the stone falls out, who is responsible? The setter? They didn’t make the prong. The manufacturer? They didn’t set the stone. The setter was a hack. Talk to the setter. The insurance company? This is the result of a material defect in the piece or damage that was there before the policy was in force. Not their problem. Talk to the manufacturer.

The solution here is in doing your due diligence. Always have a lab grading report that is specifically listed, by number, on the receipt. Get the loose diamond inspected/appraised independently PRIOR to having it set. Then have it appraised by the same appraiser after the item is complete. Your insurer is likely to require this second one anyway because it’s the one that establishes the beginning point of the policy. Any problems can and should go back to the jeweler.

4. Chain of custody.

This is another odd step. Most insurers won’t bind a policy until after you’ve taken possession of the finished item, at least briefly. That’s because you won’t have what they call “an insurable interest.” Fundamentally, you need to have personally touched the piece before they’ll bind a policy in your name.

Consider Having Your Loose Diamond Set Into a Temporary Mounting First

This can be a simple ring mounting where you can do the ‘one knee’ presentation and still have her involved in the final design process or something as simple as a single earring or a pendant. That turns the collection of diamonds and gold into “jewelry,” and that makes it insurable insofar as your insurance company is concerned. Bear in mind that doing this probably will void your return privilege with the seller… so make sure you want to keep it before you go down this road. Damage caused while taking a stone out of one insured jewelry item and setting it into a new one is covered under most policies. It’s a common transaction. Ask your agent or the underwriter for your particular company.

Here’s The Careful Process

Pick out a diamond based on the seller’s advertising. Use the GIA report and photographs to compare. Read the terms and conditions carefully, especially about returns. Use a credit card. Have them ship it to you by an insured carrier. US to US is usually FedEx. After you get it, take a look. Take it for a walk. Show it to your mom, your friends, maybe even your bride if she’s in on it. If it passes all of that, get it appraised by an independent appraiser.

You’re still not insured, so be careful! Usually you’ll have about a week. Wait for the appraiser and be careful while you carry it around. Book your appointment early. A lot of appraisers are pretty busy. If the seller of the diamond is going to be the setter, have THEM pull the FedEx ticket to send it back if they aren’t local. This puts the insurance on them. Have them make the ring and ship it back to you or pick it up, in person, if they’re nearby. If someone else is going to be setting it, be sure they’re on the list of who to show it to. Do they have any problems? Will it work in the design you have in mind?

Give yourself plenty of time. There’s no reason to add time pressure to your schedule for the proposal or whatever.

Plan a visit to the appraiser as soon as the finished item gets to you. This time it’s to quality control the work and to write the report that will become the baseline for your insurance. Is it the same stone?; Is it still in the same condition?; Is it and everything else set properly? Any other problems? You’ve already cleared the physical possession hurdle so you should be able to bind a policy based on the electronic version of the appraisers report unless there’s a problem that comes up in the appraisal. If there’s a problem, call the seller and have THEM call in the pickup with FedEx. That makes them the shipper, not you. It’s better for both of you.

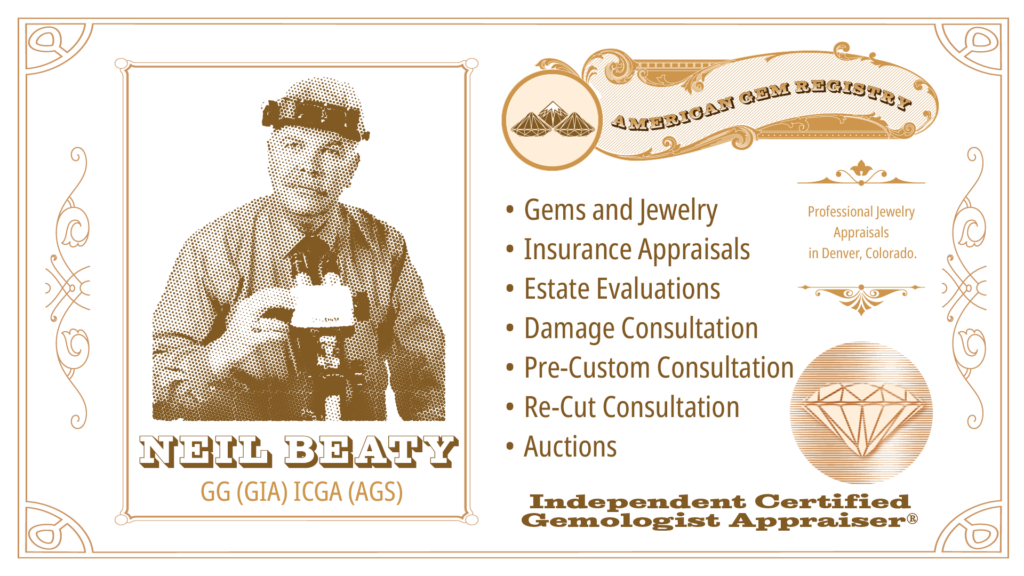

Independent Jewelry Appraisals in

Denver, Colorado

The American Gem Registry provides a variety of jewelry appraisal services in Denver, Colorado:

- Gem and Jewelry Appraisals

- Estate Evaluations

- Expert Witness

- Pre-Custom Consultation

- Re-Cut Consultation

- Damage Consultation

- Restoration Evaluation

- Re-Cut Consultation

If you have any questions, please call during my normal business hours at the number below. Or, you can schedule your Jewelry Appraisal Appointment online today!